In recent times, a growing concern has surfaced in the restaurant industry regarding the improper handling of Goods and Services Tax (GST). Some restaurants have been found guilty of canceling their GST registration after a few months but continue to charge GST on their bills. This fraud not only affects the government but also leaves unsuspecting customers at risk of overpaying for their meals.

In this blog post, we’ll explain how this scam works, its impact on consumers, and how you can protect yourself from falling victim to it.

How the GST Scam Works:

Here’s a breakdown of how some restaurants execute this fraudulent activity:

- Step 1: Obtaining GST Registration

- Initially, the restaurant registers for GST with the government, allowing them to collect GST from customers on food and beverage sales.

- Step 2: Cancelling GST Registration

- After operating for a few months, usually 6 to 12 months, the restaurant cancels their GST registration with the government. This may be done for a variety of reasons, including to avoid paying the collected tax or simply because they no longer wish to operate under GST.

- Step 3: Continued GST Charges

- Despite canceling the GST registration, the restaurant continues charging GST to customers. Most customers don’t bother verifying whether the restaurant’s GST registration is still active, which is why the scam works.

Why This Is Fraud:

This practice is a clear violation of the Goods and Services Tax Act and amounts to tax fraud. Here’s why:

- Non-Remittance of GST: Restaurants continue collecting GST from customers but fail to remit the collected amount to the government. This means the tax collected by the restaurant never reaches the exchequer.

- False Representation: Even after canceling their GST registration, the restaurant continues to represent itself as a GST-compliant business, misleading customers into believing the tax is being handled correctly.

Impact on Consumers:

- Overpayment of GST: Customers are unknowingly paying GST on their meals, thinking it is being properly remitted to the government, when in fact it’s not.

Legal Consequences for Restaurants:

Restaurants found guilty of this scam face serious consequences under the GST law:

- Penalties: They could be subjected to heavy fines for non-compliance, in addition to penalties for submitting false information to tax authorities.

- Criminal Prosecution: Depending on the severity of the fraud, criminal charges may be filed, leading to legal action and even imprisonment for responsible parties.

How to Protect Yourself as a Consumer:

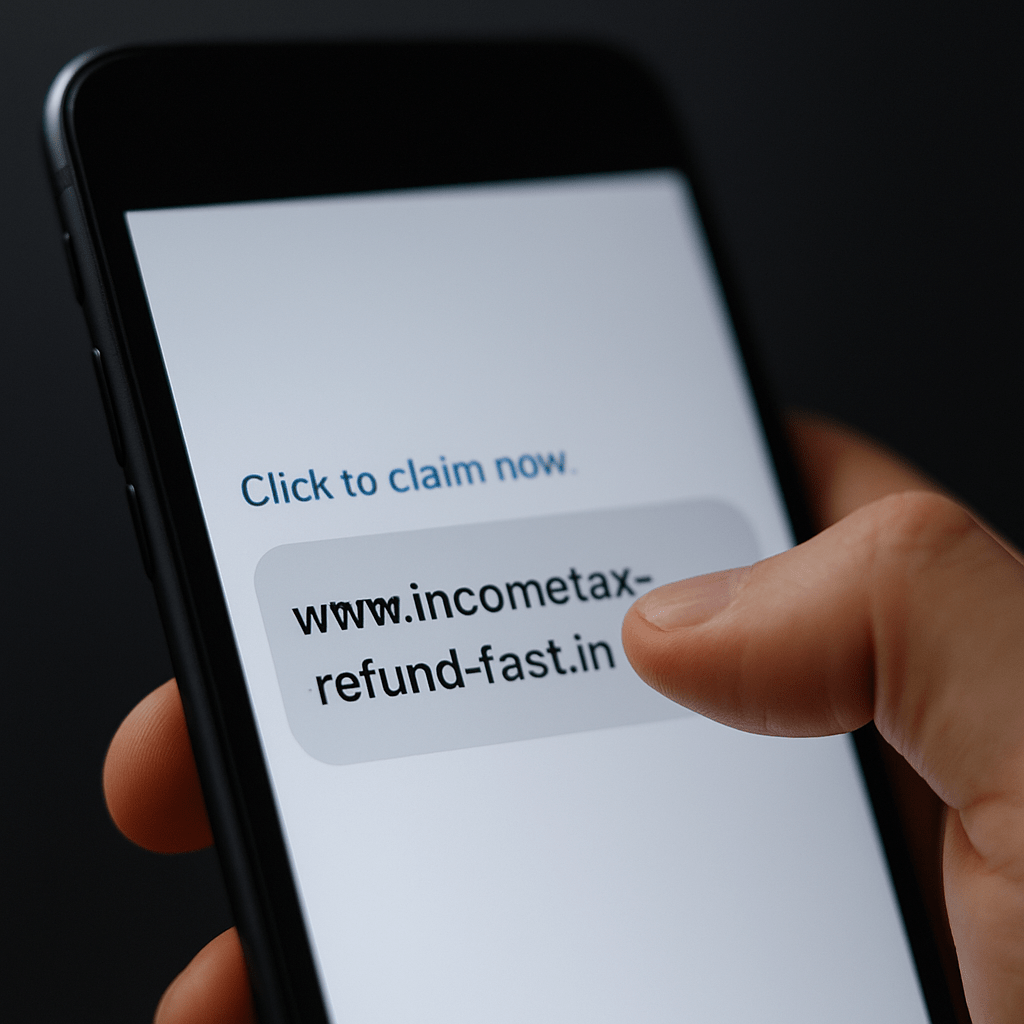

As a consumer, it’s important to be vigilant and take steps to ensure you’re not unknowingly paying GST that isn’t being remitted to the government:

- Verify GST Registration: Before paying GST, you can verify whether the restaurant’s GST registration is still active. Visit the GST portal to check their GSTIN status.

- Request a Valid Invoice: Ensure the restaurant provides a proper GST invoice with a valid GSTIN. If they don’t provide one, or if the GSTIN is invalid, it’s a red flag.

- Report Suspicious Activity: If you suspect a restaurant is involved in this scam, you can report them to the GST department through their official channels.

Conclusion:

The GST scam happening in some restaurants is a serious issue that affects both consumers and the government. By staying informed, consumers can ensure they don’t fall prey to such scams, while businesses that engage in such practices can face severe penalties.

Together, we can help maintain the integrity of the tax system and ensure fair practices in the restaurant industry.

Call to Action:

If you found this article helpful, make sure to share it with your friends and family to raise awareness. For more updates on GST laws and taxation tips, follow our blog.